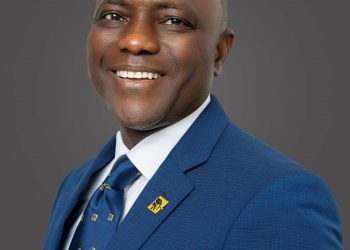

Managing Director/Chief Executive Officer, Fidelity Bank Plc, Mrs. Nneka Onyeali-Ikpe has called on the Nigeria Electronic Fraud Forum, NeFF to come with solutions to the challenges posed by electronic fraud to financial system.

According to a report published in Vanguard Newspaper, she made this call in Lagos while speaking at the 3rd quarter general meeting of NeFF.

Nneka Onyeali-Ikpe explained that e-fraud are activities carried out online to exploit individuals and business entities for financial gain.

She listed examples of e-fraud to include: Phishing; Advanced fee fraud (419); Online Auction Fraud; Identity Theft; Tech Support Scams; Online Romance Scam; Investment Scam; Business Email compromise; Ransomware; Online Rental Schemes; Pyramid Schemes; and Click Fraud.

Highlighting the rising trend of e-fraud in the country and the associated challenges, the Fidelity Bank boss said: “According to data released by NIBSS, the value of electronic payment transactions in Nigeria increased by 298% YoY from N34.04 trillion in Q1 2022 to N135.52 trillion in Q1 2023.

“As technology continues to advance at an unprecedented pace, our reliance on digital transactions has grown exponentially. However, with this rise in digital interactions, the threat of e-fraud has become a significant challenge affecting individuals, businesses, and industries alike.

“The banking industry lost a total of N14.3 billion to electronic fraud in 2022, up from the N12.7b reported in 2021. As at Q1 2023, the total fraud loss was N5b according to the NIBSS Annual Fraud Landscape reports.

“The Mobile channel is the most exploited channel by fraudsters in 2021 and 2022 with 42,821 and 45,090 reported fraud records respectively. Total fraud count in 2021 was 123,918 and 101,668 in 2022.

“E-fraud has permeated multiple industries, spanning from banking and finance to e-commerce and beyond. These cybercriminals leverage advanced methods to exploit vulnerabilities, gaining unauthorised access to crucial data and funds. The repercussions of e-fraud are not limited to financial losses; they also extend to eroding trust and eroding brand reputation.