Wema Bank, Nigeria’s foremost innovative bank and pioneer of Africa’s first fully digital bank, ALAT, has officially launched CoopHub, a new digital solution for Cooperative Societies. The groundbreaking platform was unveiled at the launch ceremony held on May 10th, 2024, to commemorate the 79th anniversary of the Bank.

CoopHub, the first of its kind in the Nigerian banking industry, is a digital platform designed strategically to transform the way Cooperative Societies operate by providing tailored solutions that bridge the gaps in the traditional framework of Cooperative Societies. The unique platform insulates Cooperative Societies against prevalent struggles like manual recordkeeping, limited access to loans, poor communication, insecurity, and other restrictions, supporting them with the solutions needed to not only mitigate these problems but also operate with the utmost efficiency.

With CoopHub, leaders of Cooperative Societies can manage every aspect of their community’s operations from a simplified dashboard accessible on their phones, seamlessly managing their Cooperative Society’s finances, communication, member records, analytics and every other detail in real time and on the go. Members of the Cooperative Societies also enjoy increased access to loans, seamless contribution tracking, secure transactions, and easy communication with the leaders. Essentially, CoopHub helps Cooperative Societies maintain 100% transparency, reliability, and security, with the option of white labelling for a customised experience.

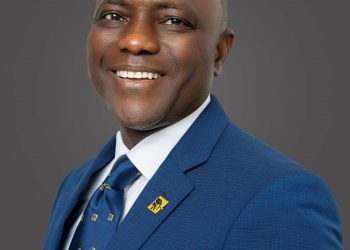

Disclosing the Bank’s motive for creating CoopHub, Wema Bank’s MD/CEO, Moruf Oseni, highlighted the Bank’s commitment to innovation and customer-centricity. “Cooperative Societies have many pain points. As a bank that is committed to empowering lives through innovation, we examined the end-to-end value chain of Cooperative Societies and launched CoopHub to provide solutions that address the pains and headaches in the Cooperative Society experience for both the leaders of these communities and the members. CoopHub is the future of Cooperative Societies and we have designed every detail to address the needs of every player in the Cooperative Society ecosystem and empower these communities for optimal productivity”, he said.

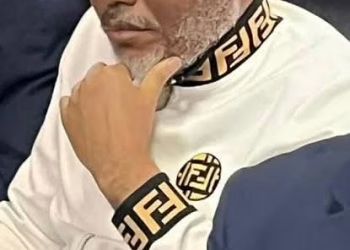

Delving into the unique features of CoopHub, Solomon Ayodele, Wema Bank’s Head of Innovation, added, “CoopHub is taking Cooperatives to an era where conflicts, stressful physical meetings, mistrust, inadequate capital, poor recordkeeping and inefficient governance are all a thing of the past. With a digitised database for all records, a dedicated User Management section for leaders to manage members efficiently, a transparent overview of contributions for both leaders and members, seamless communication framework that allows for easy planning of meetings and events, and a host of other unique features, CoopHub truly is the solution that every Cooperative Society needs. To promote community and financial security, CoopHub also offers a three-factor authentication system that ensures that every withdrawal from the Cooperative Society’s account is subject to an approval of three members of the Cooperative Society, including the Admin. We have been very intentional with CoopHub and I encourage every Cooperative Society to come on board and experience the future of Cooperative Societies through CoopHub”, Ayodele concluded.

CoopHub is now live and open to every Cooperative Society across the world. This futuristic solution is set to not only empower Nigerian lives with increased access to their needs through Cooperative Societies, but also revolutionise Cooperative Society operations for the best.

To onboard a Cooperative on CoopHub, simply register at https://coophub.alat.ng/