Nigeria’s leading commercial bank and Africa’s most agile company, Sterling Bank Limited, has made history by migrating to what is believed to be the continent’s first ever indigenous core banking solution called SeaBaaS.

The implementation of SeaBaaS, developed by Peerless, marks the completion of a new banking system announced to customers in August 2024.

This strategic move positions Nigeria as a leader in digital banking, driven by local talent and cutting-edge technology.

Leveraging advanced data analytics and artificial intelligence, the system promises to enhance customer experience and operational efficiency, providing smarter, faster financial services.

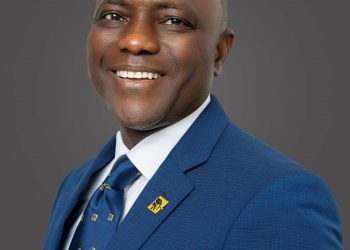

Speaking on the achievement, Abubakar Suleiman, CEO of Sterling Bank, said SeaBaaS is the first fully developed core banking platform that is wholly built and owned by an African technology company.

He described the development as the start of a new revolution in Africa’s drive for economic self-sufficiency, noting that the intellectual property underpinning SeaBaas will be available to partners across the continent in the coming months.

For regulators, it ensures greater transparency, robust reporting, and compliance with evolving standards.

“Partnering with Peerless to create SeaBaaS is not just a milestone for us; it is a renewal of our resolve and ambition to remain a world-class organization. It is proof that African institutions can do great things that will make the world stand up and take notice of us,” said Suleiman.

“We are once again proving that the notion of Nigerian banking being one of the most technologically advanced is not just a myth, but a reality that is manifested in the quality of solutions we can develop, and services we can deliver to our customers.”

Suleiman explained that the transition to SeaBaaS represents many things to many people. “For the African banking industry, it is the continent’s first indigenously conceived and engineered core banking application, built and owned entirely by a Nigerian company, with every line of code, database configuration and interface proudly African, delivered by homegrown talent.

“For our customers, it offers faster transactions, enhanced security and innovative financial products tailored to their needs. For regulators, it ensures greater transparency, robust reporting and compliance with evolving standards.”

The bank’s CEO acknowledged the challenges faced during the implementation, stating that implementation issues had been resolved, with the institution’s full bouquet of digital banking services being restored in phases for customers’ use.

According to him, “This successful deployment reminds us that nothing truly valuable comes without challenges. While this transition has tested our systems and patience, it also reinforced our commitment to innovation and excellence. We enter this new phase confident that the migration will deliver unmatched efficiency and transformative customer experiences.”

He also pointed out the financial implications of the migration, noting that African banks collectively spend hundreds of millions of dollars annually on foreign core banking systems, which exacerbates the continent’s trade balance issues. The introduction of SeaBaaS not only sets a new benchmark for Nigerian financial services but also paves the way for a future where African institutions can reduce their technology costs, thereby enhancing financial inclusion, he said.

Sterling Bank’s migration to SeaBaaS adds to its history of being at the forefront of market-leading innovations. The bank pioneered Nigeria’s first contactless prepaid transport card (FarePay) and the first automated retail lending solution (Specta).

It has also partnered with state governments to deploy innovations like the first drone delivery system for pharmaceutical consumables with Zipline in Kaduna, and digitized medical records.