In line with its strategic intent to always provide solutions and business support for its customers, leading financial institution, Fidelity Bank Plc has announced plans to host the maiden edition of the Fidelity International Trade and Creative Connect (FITCC) in partnership with Invest Africa.

Scheduled to hold on Tuesday, 15 and Wednesday, 16 November 2022 in London, United Kingdom, FITCC will host leading businesses, entrepreneurs, investors and regulators operating in the commodity, service, creative, fashion and fintech sectors in Nigeria, the United Kingdom and the wider European market, to promote Nigeria’s Non-Oil Exports and facilitate integrations to global supply-chain networks via partnerships, co-creation opportunities and foreign direct investments.

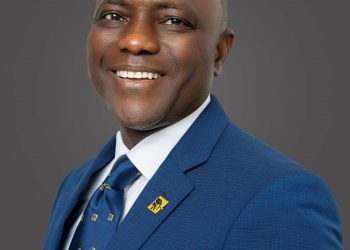

According to a joint press release issued by the two organisations, Managing Director/Chief Executive Officer, Fidelity Bank Plc, Nneka Onyeali-Ikpe stated, “FITCC is the next step in a series of activities we organized over the years to promote exportation in Nigeria. We started by investing in growing local capacity through our Export Management Programme in conjunction with the Lagos Business School and providing funding options for exporters.

Over the years, we have remained committed to promoting non-oil exports from Nigeria, and through the FITCC, we are opening new opportunities in the international markets for Nigerian exporters and contributing positively to the growth of our economy. We are delighted to have Invest Africa collaborate with us on this amazing journey as we connect local businesses to importers and investors in the United Kingdom and Europe.”

Besides product exhibitions, FITCC will feature keynotes/plenaries, syndicate rooms for closed-door engagements with industry leaders, deal/meeting rooms, art exhibitions, themed theatrical performances, networking cocktails and side fashion shows.

“As a leading business and investment platform, Invest Africa is thrilled to be partnering with Fidelity Bank on their inaugural FITCC conference in London this November. With a global footprint of more than 400 member companies, comprising multinationals, private equity firms, institutional investors, development finance institutions, professional service organisations, government bodies and entrepreneurs, we are well placed to support the bank in bringing the right partners and delegates to the event.

The Nigerian market is hugely important to our members and there is no better time than now to showcase the extensive export capacity that Nigeria holds.,” commented Alison Kingsley-Hall, Head of Membership, Invest Africa.