The Central Bank of Nigeria (CBN) has directed commercial banks to begin the payment of the new naira notes to customers over the counter.

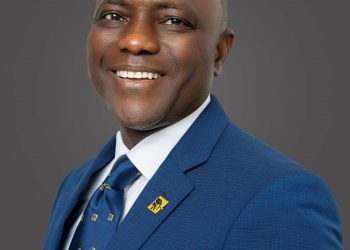

This is according to a Thursday statement signed by the Bank’s Director, Corporate Communications Osita Nwanisobi. He said it is part of moves to ameliorate the plight of Nigerians who are finding it hard to get the new notes.

“In line with this resolve, the Governor, Mr. Godwin Emefiele, has directed deposit money banks (DMBs) to commence the payment of the redesigned Naira notes over the counter, subject to a maximum daily payout limit of N20,000,” the statement added.

While admitting the difficulties Nigerians have faced in trying to get money Automated Teller Machines (ATMs), the apex bank reassured of its commitment to making the process seamless.

It also vowed to prosecute racketeers of the new naira notes, saying it is working with relevant agencies to make that happen.

“We have equally noticed the queues at Automated Teller Machines (ATMs) across the country and an upward trend in the cases of people stocking and aggregating the newly introduced banknotes they serially obtain from ATMs for reasons best known to them. Also worrisome are the reported cases of unregistered persons and non-bank officials swapping banknotes for members of the public, purportedly on behalf of the CBN,” it warned.

“We wish to state unequivocally that, contrary to the practice of these unpatriotic persons, it is unlawful to sell the Naira, hurl (spray), or stamp on the currency under any circumstance whatsoever.

“For the avoidance of doubt, Section 21(3) of the Central Bank of Nigeria Act 2007 (As amended) stipulates that ‘spraying of, dancing or matching on the Naira or any note issued by the Bank during social occasions or otherwise howsoever shall constitute an abuse and defacing of the Naira or such note and shall be punishable under the law by fines or imprisonment or both.’

“Similarly, Section 21(4) states that ‘It shall also be an offence punishable under Sub-section (1) of this section for any person to hawk, sell or otherwise trade in the Naira notes, coins or any other note issued by the Bank.’”