Zenith Bank Plc has announced its audited results for the year ending December 31, 2022, achieving an impressive double-digit growth of 24% in gross earnings from NGN765.6 billion reported in the previous year to NGN945.5 billion in 2022.

This is despite the persistent challenging macroeconomic environment and headwinds.According to the audited financial results for the 2022 financial year presented to the Nigerian Exchange (NGX), the double-digit growth in gross earnings was driven by a 26% year-on-year (YoY) growth in interest income from NGN427.6 billion to N540.2 billion and a 23% year-on-year (YoY) growth in non-interest income from NGN309 billion to NGN381 billion.

Profit before tax also grew by 2% from NGN280.4 billion to NGN284.7 billion in the current year. The increase in profit before tax was due to the significant growth in all the income lines.Impairments grew by 107% from NGN59.9 billion to NGN124.2 billion, while interest expense grew 63% YoY from N106.8 billion to N173.5 billion, respectively.

The impairment growth, which also resulted in an increase in the cost of risk (from 1.9% in 2021 to 3.3% in the current year), was due to the impact of Ghana’s sovereign debt restructuring programme.

The growth in interest expense increased the cost of funds from 1.5% in 2021 to 1.9% in 2022 due to hikes in interest rates globally. Customer deposits increased by 39%, growing from NGN6.47 trillion in the previous year to NGN8.98 trillion in the current year.

The growth in customer deposits came from all products and deposit segments (corporate and retail), thus consolidating the bank’s market leadership and indicating customers’ trust.

The continued elevated yield environment positively impacted the bank’s Net-Interest-Margin (NIM), which grew from 6.7% to 7.2% due to an effective repricing of interest-bearing assets. Operating expenses grew by 17% YoY, but growth remains below the inflation rate. Total assets increased by 30%, growing from NGN9.45 trillion in 2021 to NGN12.29 trillion, mainly driven by growth in customer deposits.

With the steady and continued recovery in economic activities, the Group prudently grew its gross loans by 20%, from NGN3.5 trillion in 2021 to NGN4.1 trillion in 2022, which increased the Non-Performing Loan (NPL) ratio modestly from 4.2% to 4.3% YoY.

The capital adequacy ratio decreased from 21% to 19%, while the liquidity ratio improved from 71.2% to 75%. Both prudential ratios are well above regulatory thresholds.

In 2023, the Group intends to expand its frontiers as it also reorganises into a holding company structure, adding new verticals to its businesses and growing in all its chosen markets, both locally and internationally.As a testament to its commitment to shareholders, the bank has announced a proposed final dividend payout of N2.90 per share, bringing the total dividend to N3.20 per share.

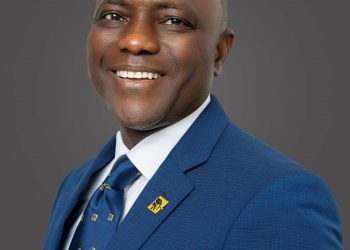

In recognition of its track record of excellent performances, Zenith Bank was recognised as the Number One Bank in Nigeria by Tier-1 Capital, for the 13th consecutive year, in the 2022 Top 1000 World Banks Ranking published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards 2020 and 2022; Best Bank in Nigeria, for three consecutive years from 2020 to 2022, in the Global Finance World’s Best Banks Awards; Best Commercial Bank, Nigeria 2021 and 2022 in the World Finance Banking Awards; Best Corporate Governance Bank, Nigeria in the World Finance Corporate Governance Awards 2022; Best in Corporate Governance’ Financial Services’ Africa, for three consecutive years from 2020 to 2022, by the Ethical Boardroom; Best Commercial Bank, Nigeria and Best Innovation In Retail Banking, Nigeria in the International Banker 2022 Banking Awards. Also, the bank emerged as the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands 2020 and 2021, and Retail Bank of the year, for three consecutive years from 2020 to 2022, at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards. Similarly, Zenith Bank was named as Bank of the Decade (People’s Choice) at the ThisDay Awards 2020, Most Innovative Bank of the Year 2019 by Tribune Newspaper, Bank of the Year 2020 by Independent Newspaper, Bank of the Year 2021 by Champion Newspaper, Bank of the Year 2022 by New Telegraph Newspaper, and Most Responsible Organisation in Africa 2021 by SERAS Awards.