Reinforcing its position as one of Nigeria’s most profitable financial institutions, Wema Bank, Nigeria’s oldest indigenous bank, most innovative bank and pioneer of Africa’s first fully digital bank, ALAT, has received a unanimous vote of confidence from its shareholders across Nigeria as it disclosed a record-breaking financial performance at its 2024 Annual General Meeting (AGM). The Wema Bank 2024 AGM held virtually in Lagos on Thursday, May 22, 2025.

According to the Bank’s 2024 Annual Report, Wema Bank, in 2024, recorded an all-time-high performance, with Gross Earnings growing by 91.51% from N225.75 billion in FY 2023 to N432.34 billion in FY 2024; Profit before Tax (PBT) increasing by 135.16% to N102.51 billion in FY 2024 from N43.59 billion in FY 2023, and Profit After Tax (PAT) increasing by 140.13% to N86.29 billion from N35.93 billion reported in FY 2023; Total Deposits rose by 35.65% to N2,523.82 billion in FY 2024 from N 1,860.57 billion in FY 2023 and Total Assets stood at N3,585.05billion in FY 2024, representing a 60.04% increase over the N2,240.06billion recorded in the corresponding year of 2023 and placing the Bank squarely above the One trillion Naira mark, a milestone the Bank surpassed in Q3 2021.

The Bank also grew its loans to customers by 49.94% to close FY 2024 at N1,201.21 billion from the N801.10 billion recorded in 2023. Impressively, the Wema and ALAT brands continue to win public acceptance and market relevance as the Bank continues to record growth in its retail deposit drive. 2024 has proven beyond doubt to be an exceptional for the Bank with earnings growing by 91.51% year on year with earnings per share at 483.2 kobo. Additionally, the Bank’s Non-Performing Loan rate closed at 3.86%, a reduction from FY 2023 position. It is no surprise that the Bank received unanimous commendation from shareholders, with both internal and external stakeholders expressing full confidence in the Bank’s stable outlook and successful financial future.

Among the shareholders who expressed a vote of confidence in Wema Bank were Mr. Matthew Akinlade, who commended the Management for a performance he regarded as “very outstanding”, and Ambassador Doctor Olatunde Okelana, who described the 2024 financial performance of Wema Bank as “historical”, commending Wema Bank’s proactive approach to employee well-being.

Mrs. Bisi Bakare, National Coordinator of the Pragmatic Shareholders Association of Nigeria, also added, “I want to start by commending Wema Bank’s outstanding performance despite the challenging macroeconomic performance. On gender inclusion, I would also like to commend Wema Bank for an impressive gender diversity on the board with 5 out of 11 directors being female, representing a remarkable 38% ratio. Furthermore, I want to seriously commend the succession plan of Wema Bank, and the board for achieving 100% attendance in meetings, which shows a full commitment on their part”.

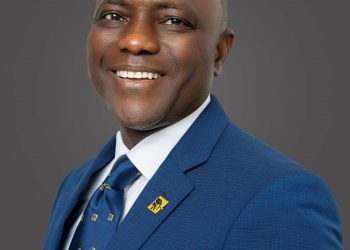

Anchoring the Wema Bank 2024 AGM, Dr. Oluwayemisi Olorunshola, the Chairman of Wema Bank, expressed the Bank’s gratitude and appreciation to its shareholders, customers, employees, regulators, partners and other stakeholders, for their continued support and contributions to the Bank’s outstanding performance for the year in view, reiterating the Bank’s commitment to sustain the upward surge in its performance in the decades to come.

Alluding to the Bank’s plan for sustaining the gargantuan growth recorded in 2024, Moruf Oseni, the Bank’s MD/CEO, added, “We will continue to deliver best-in-class financial solutions, invest in second-to-none technology, reinforce our internal framework for maximum efficiency and remain fully committed to innovation and service excellence, as we continue to provide optimum returns for every stakeholder of Wema Bank. The N150 billion Rights Issue window ended yesterday May 21st, 2025. However, we have raised a motion to raise another N50 billion through private placement, and with your permission, we will proceed with that, come June 2025”.

“At the end of it all, what we expect is that Wema Bank will have qualifying capital slightly north of N267 billion, which allows us to sustain the resilient and robust franchise that we have built together, to keep Wema Bank thriving as a force to be reckoned with in the industry. Wema Bank stands strong at 80 and in the decades to come, I can assure you that the growth we are experiencing today, is just a tip of the iceberg”, Oseni concluded.

Wema Bank 2024 AGM saw the Bank’s shareholders authorise a number of decisions including the re-election of board members, remuneration of Audit and Board members, and payment of dividends of N1 per share.

From marking the incredible milestone of its 80th anniversary to making significant strides towards meeting the CBN recapitalisation benchmark for 2026 and achieving a record-breaking 2024 financial performance that has sustained an unparalleled growth streak over the past decade, Wema Bank has proven its capacity to remain at the forefront of the African financial industry without compromising on delivering unmatched value to stakeholders.